Global trade, which is being roiled by the Trump administration’s tariff policy, has supplanted interest rates as the main concern of family offices, while these organizations broadly held fire on asset allocations and waited for more clarity on the financial outlook, a Citigroup survey found.

Family offices largely maintained their asset allocations, making fewer shifts than in 2024. Half of respondents kept their fixed income holdings steady, and two thirds did so in real estate. Private equity saw the most notable bullish movement, with those increasing allocations outnumbering those decreasing by 26 per cent.

The findings, in an 81-page report from the US bank, were drawn from Citi Wealth’s 10th annual Family Office Leadership Summit in June. The bank’s family offices group works with more than 1,800 FOs globally. Its survey, which drew 346 respondents, was conducted in June and July.

Among the minority who altered their public equity and fixed income exposure, a net 11 per cent and 14 per cent made increases respectively, down from last year’s levels. Regionally, Asia Pacific made the greatest increases in public equity, with the Americas leading in private equity.

“Overall, though, ongoing trade and monetary policy uncertainty, geopolitical tensions and fiscal concerns may have kept many family offices in wait-and-see mode,” authors of the report said.

Family offices expressed optimism about 12-month portfolio returns. Possible drivers of this positive sentiment include potential US deregulation, interest rate cuts and advancements in artificial intelligence. A significant cohort anticipated returns between 10 and 15 per cent, with an additional 8 per cent expecting returns exceeding 15 per cent.

There was not much agreement, however, on which asset classes would deliver the stronger performance, the report said.

To hedge or not to hedge – that is the question

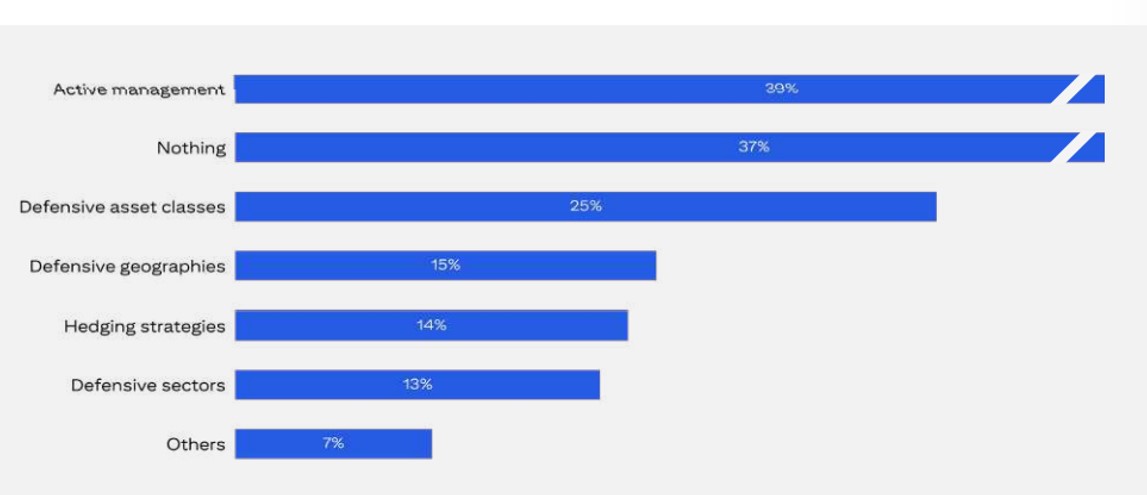

About two-thirds of FOs took steps to contain the impact of market gyrations after President Trump announced that he was imposing sanctions on April 2. Thirty-nine per cent of respondents cited active management as their response to the market fallout. They allocated more to asset classes and geographies which they perceived as defensive . Some 14 per cent engaged in hedging strategies, while 13 per cent sought out perceived defensive sectors.

Source: Citi Wealth 2025 Global Family Office Report

Direct route to goal

Turning to a topic that has surfaced before in family office conversations, 70 per cent of respondents said they were engaged with direct investments. Of those, four out of 10 said they had increased or significantly increased their activity in the last year. The report said this suggested family offices’ confidence in their ability to select deals that drive returns.

War worries

Trade wars were this year’s top concern . In 2024, by contrast, respondents were most preoccupied with the evolution of interest rates, a worry that has since slipped to fourth place amid declining rates across many economies. Like last year, US-China relations were the second most common concern , followed by a return of inflation .

The Middle East conflict and the Russia-Ukraine war were seen as substantially lesser risks than last year , possibly because investors have become used to these events, the bank said.

Mixed risk abilities

Family offices mentioned risks related to investing more than any other kind . This corresponds to the ongoing interest in risk analyses and hedging strategies that we are seeing, particularly since April’s selloff, the report said.

The next most mentioned were risks linked to family office operations and the family . Liquidity and geopolitical issues were not far behind. More than four fifths of respondents said their investment risks were well managed or very well managed, albeit slightly down from last year’s 87 per cent. But they felt less assured when it came to their management of cybersecurity and geopolitical risks.

Perhaps unsurprisingly, AI made an appearance in this year’s study. The proportion of respondents saying they have deployed AI nearly doubled from the level in 2024, particularly for automating manual tasks and investment analysis or forecasting . However, this transformational technology has yet to be integrated across all functions, especially those involving risk and compliance, the report said.

A lack of awareness and expertise are holding family offices back from using AI, the report added.